Geely Automobile Holdings (0175.HK) enters September 2025 with improving scale but tight margins, setting the stage for a cautious three‑year outlook to September 2028. The company reports trailing revenue of 271.69B, net income of 15.06B and a profit margin of 5.57%, supported by total cash of 69.11B against total debt of 24.11B. Quarterly revenue grew 17% year over year, but quarterly earnings growth declined 60.80%, highlighting pricing pressure and mix effects. Shares closed near 18.20, up 73.38% over 12 months, with a 1.81% forward dividend yield and a 20.44% payout ratio. With a current ratio of 0.95, operating cash flow of 22.59B and levered free cash flow of 37.37B, we focus on margin trajectory, product competitiveness and capital discipline as key determinants of returns.

Key Points as of September 2025

- Revenue: trailing 12‑month revenue of 271.69B; quarterly revenue growth at 17% year over year; gross profit 43.05B.

- Profit/Margins: profit margin 5.57%; operating margin 3.50%; ROE 16.76%; ROA 3.07%.

- Sales/Backlog: sales growth evident in revenue; backlog not disclosed here; focus on mix and pricing discipline.

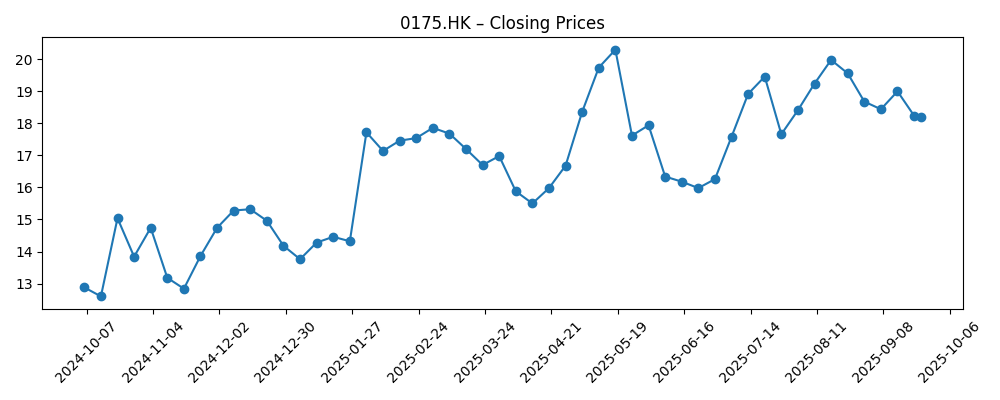

- Share price: recent close ~18.20 (2025‑09‑24); 52‑week range 10.460–20.850; 50‑day MA 18.922; 200‑day MA 17.101; 52‑week change 73.38%.

- Cash, debt and liquidity: total cash 69.11B vs total debt 24.11B; current ratio 0.95.

- Cash flow: operating cash flow 22.59B; levered free cash flow 37.37B.

- Dividends: forward dividend rate 0.33; forward yield 1.81%; payout ratio 20.44%; last ex‑dividend date 2025‑06‑11.

- Market cap: implied roughly 10.12B shares outstanding × ~18.20 per share ≈ ~184B (indicative).

- Ownership & sentiment: insiders hold 42.55%; institutions 23.35%; beta 1.14 suggests moderate market sensitivity.

Share price evolution – last 12 months

Notable headlines

Opinion

Geely’s equity story in the next three years hinges on converting scale into sustainable profitability. The trailing revenue base of 271.69B and 17% quarterly revenue growth indicate solid demand and product breadth, yet the 60.80% decline in quarterly earnings growth underscores how competitive pricing and input costs can overwhelm volume gains. The share price has re‑rated significantly over the past year, with a 52‑week change of 73.38%, but now trades close to the 50‑day moving average and still above the 200‑day trend. That setup typically places the burden of proof on margins and cash generation: investors may expect operational improvements to validate the recent rally. With a profit margin at 5.57% and operating margin at 3.50%, even small efficiency gains, mix upgrades, and cost reductions could have an outsized impact on equity value.

The legal inquiry flagged by the Pomerantz Law Firm introduces a governance overhang that could influence the multiple, at least near term. Such investigations often result in either no further action or in remedial steps; markets usually price in uncertainty until clarity emerges. For Geely, timely disclosure, robust internal controls, and demonstrable board oversight would help mitigate perceived risk. If the matter is resolved without significant findings, investor attention should revert to fundamentals—unit momentum, pricing resilience, and execution on new model cycles. Conversely, an extended legal overhang could elevate risk premia, slow institutional inflows, and amplify sensitivity to quarterly results, particularly if margins remain tight.

Balance sheet and cash generation provide a buffer. Total cash of 69.11B versus debt of 24.11B affords flexibility for capex, software and platform investment, and selective international expansion, while maintaining shareholder returns through a forward dividend yield of 1.81% and a 20.44% payout ratio. Still, a current ratio at 0.95 highlights working‑capital discipline as a focus area, especially if supply chains or demand cycles become choppy. Operating cash flow of 22.59B and levered free cash flow of 37.37B, if sustained, can support product cadence and cost‑down programs that are critical in a price‑competitive EV landscape. The portfolio’s ability to shift mix toward higher‑margin variants and features will be central to improving return on invested capital.

Valuation sensitivity remains high after the strong share price recovery. With beta at 1.14, the stock tends to move modestly more than the market, and catalysts—product launches, cost inflections, or regulatory shifts—can produce outsized reactions. In a constructive path, steady revenue growth, improving utilization, and disciplined incentives could lift margins and keep cash conversion healthy. In a more guarded path, intensified domestic competition and prolonged legal uncertainty could compress spreads and slow earnings momentum. Over a three‑year horizon, we think outcomes will be driven less by macro swings and more by company‑specific execution: delivering competitive vehicles profitably, sustaining innovation cadence, and maintaining prudent capital allocation.

What could happen in three years? (horizon September 2025+3)

| Best case | Competitive products gain share without heavy discounting; operating efficiency and mix improvements lift margins; legal matters resolve benignly; cash generation supports investment and dividends, allowing a valuation re‑rating. |

| Base case | Revenue grows steadily as new models offset pricing pressure; margins stabilize around current levels with incremental efficiency gains; legal noise fades; total returns track earnings and dividends. |

| Worse case | Price competition intensifies and weighs on margins; legal overhang persists; working‑capital needs tighten given a sub‑1 current ratio; investment plans are curtailed, leading to underperformance versus peers. |

Projected scenarios are based on current trends and may vary based on market conditions.

Factors most likely to influence the share price

- Pricing discipline and cost reductions amid ongoing EV and ICE price competition in China and export markets.

- Execution on product cadence, platform efficiency, and software features that lift mix and margins.

- Outcome and duration of the investor investigation and any related governance or disclosure actions.

- Cash conversion and working‑capital management given a current ratio below 1.

- Policy and macro developments, including subsidies, trade rules, and input‑cost volatility.

- Capital allocation consistency across dividends, potential buybacks, and strategic investments.

Conclusion

Geely enters the next three years with meaningful scale, positive cash generation, and a balance sheet that can fund innovation, but also with thin operating margins and an added governance question mark. The strong 12‑month share price performance raises the bar for execution: investors will likely demand evidence that pricing can hold and costs can fall without sacrificing growth. If management sustains revenue expansion while improving margins and resolving legal uncertainty, the equity story could transition from a volume‑led to a profit‑led phase, supporting further multiple normalization. If, however, price pressure persists and the investigation lingers, the stock may trade more on near‑term deliveries and incentives than on long‑term strategy. On balance, we see a wide but navigable path: disciplined capital allocation, mix upgrades, and transparent governance are the key levers that can shape outcomes into September 2028.

This article is not investment advice. Investing in stocks carries risks and you should conduct your own research before making any financial decisions.