Ford Motor Company’s shares have recovered through the summer, trading near the upper end of their 52‑week range as investors weigh steady top‑line growth against quality costs and a full cycle of recall headlines. The automaker’s trailing‑12‑month revenue stands at 185.25B, but profitability remains thin (1.70% net margin; 1.07% operating margin). Cash of 28.28B and operating cash flow of 18.53B provide flexibility, while leverage is elevated at 160.24B of total debt. The stock offers a 0.60 per‑share forward annual dividend (5.17% yield) with a 96.15% payout ratio, a key watch item. With a 5‑year beta of 1.53, Ford remains a cyclical, sentiment‑driven name. This three‑year outlook assesses how product quality, capital allocation, and execution on trucks and electrification could shape returns through September 2028.

Key Points as of September 2025

- Revenue: TTM revenue 185.25B; quarterly revenue growth (yoy) 5.00%; TTM gross profit 13.38B.

- Profit/Margins: Profit margin 1.70%; operating margin 1.07%; EBITDA 8.55B; ROE 7.15%; ROA 0.63%.

- Cash & Leverage: Total cash (mrq) 28.28B; total debt 160.24B; current ratio 1.10; debt/equity 355.45%.

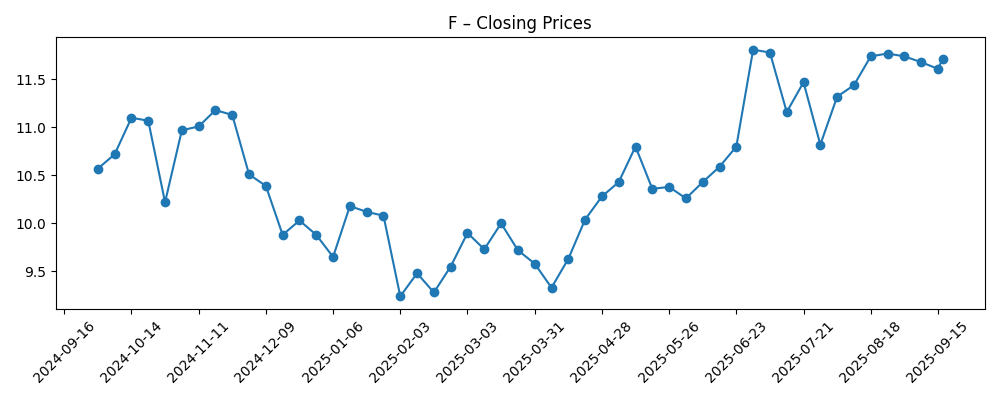

- Share price: Mid‑September trade around 11.68–11.72; 52‑week range 8.44–11.99; 50‑DMA 11.46; 200‑DMA 10.43; 52‑week change 5.74% vs S&P 500 at 17.59%.

- Dividend: Forward annual dividend 0.60 per share (5.17% yield); payout ratio 96.15%; last dividend date 9/2/2025; ex‑div 8/11/2025.

- Ownership & Sentiment: Shares outstanding 3.91B; float 3.87B; institutions hold 63.94%; short interest 4.70% of float; short ratio 2.82; beta (5Y) 1.53.

- Sales/Backlog: Order book not disclosed in snapshot; revenue growth positive; trucks remain core volume driver.

- Analyst view: Focus on margin recovery, warranty/recall costs, and dividend coverage; execution on quality seen as central to re‑rating.

- Market cap: Not provided in snapshot; large float suggests sizable capitalization relative to peers.

Share price evolution – last 12 months

Notable headlines

- Ford to recall more than 355,000 trucks over instrument panel issue, NHTSA says

- Ford recalls over 100K F-150 pickups for broken rear axle bolts

- Ford F-150 Owners Sue Over Oil-Thirsty V8 Engines

Opinion

Ford’s stock has put in a more constructive pattern over the last six months, rebounding from February’s sub‑10 levels and holding above the 200‑day moving average into mid‑September. That stabilization coincided with modest 5% year‑over‑year revenue growth and improving sentiment around cyclical auto demand. However, the shares continue to trade in a tight band near the 50‑day average as investors parse quality headlines and their knock‑on effects for warranty accruals and production cadence. With the 52‑week high at 11.99 and recent closes around the 11.6–11.8 area, the next leg likely hinges on whether management can demonstrate tangible reductions in defect rates and warranty expense without sacrificing pricing or incentives on key truck nameplates.

The recall cluster and the F‑150 engine lawsuit underscore the core execution risk: even when revenue is robust, thin margins leave little cushion for unexpected quality costs. Ford’s TTM profit and operating margins (1.70% and 1.07%) illustrate the narrow runway. If recall remedies, supplier containment, and redesigned components stick, the payoff could be meaningful through lower warranty charges and fewer production disruptions. Conversely, if issues persist, investors may fear a rolling series of accruals that squeeze EBITDA and free cash flow. In that case, sentiment could quickly rotate from “quality is being fixed” to “quality is a structural drag,” particularly given the stock’s higher beta profile.

Capital allocation is the second pillar of the three‑year debate. The dividend’s 5.17% yield is attractive, but the 96.15% payout ratio limits flexibility if macro conditions soften or quality costs rise. Operating cash flow of 18.53B and cash of 28.28B support near‑term commitments, yet leverage is material at 160.24B of total debt. The path forward likely features selective investment in core trucks, disciplined EV rollout pacing, and incremental cost take‑outs. Evidence that Ford can hold the dividend while nudging margins higher would be a powerful re‑rating catalyst; evidence to the contrary would likely cap the multiple near cycle‑average levels and keep the stock range‑bound.

Finally, positioning and technicals can amplify fundamentals. Short interest is modest at 4.70% of float with a short ratio of 2.82, suggesting room for both squeezes on positive catalysts and quick reversals on disappointments. With the 50‑day and 200‑day moving averages at 11.46 and 10.43, respectively, sustained closes above the prior 52‑week high could shift the narrative from “repair and maintain” to “recover and grow.” Over a three‑year horizon, the swing factor is whether Ford turns today’s quality overhang into a margin‑expansion story while maintaining balanced capital returns. That will determine if the stock graduates from a high‑yield cyclical to a more durable compounder.

What could happen in three years? (horizon September 2025+3)

| Scenario | Outcome by September 2028 |

|---|---|

| Best | Quality programs cut warranty costs; margins lift from a low base; cash generation supports ongoing capex and a steady (or modestly higher) dividend. Execution on core trucks and a disciplined electrification cadence drive consistent revenue growth. Shares sustain levels above the prior 52‑week high of 11.99. |

| Base | Operational fixes progress unevenly; revenue growth stays positive; dividend is maintained at current run‑rate; balance sheet remains manageable. Shares oscillate around long‑term averages, responding to macro and model‑launch cycles without a decisive re‑rating. |

| Worse | Recurring recalls and legal liabilities pressure margins and cash; a cyclical slowdown tightens auto credit. Management prioritizes balance sheet repair, potentially resetting the dividend. Shares retest the 52‑week low of 8.44 and remain range‑bound amid weaker sentiment. |

Projected scenarios are based on current trends and may vary based on market conditions.

Factors most likely to influence the share price

- Quality costs from recalls and litigation affecting margins, cash flow, and brand perception.

- Pricing power and incentives across trucks and SUVs amid competitive and macro pressures.

- Execution on cost reductions and product cadence, including the pace of electrification investments.

- Interest rates and auto credit availability impacting demand and financing spreads.

- Dividend policy and capital allocation given a 96.15% payout ratio and elevated leverage.

- Supply chain stability and commodity/input costs that influence production and profitability.

Conclusion

Ford enters the next three years with a sturdy revenue base and visible brand equity in full‑size trucks, but thin profitability and ongoing quality headlines keep the debate finely balanced. The investment case hinges on converting operational fixes into sustainably lower warranty expense and margin recovery while preserving financial flexibility. The dividend’s 5.17% yield provides carry, yet the high payout ratio limits room for error, making execution and cash discipline central to total returns. Technically, the stock has stabilized near the top of its 52‑week range and above key moving averages, but a decisive break higher likely requires evidence of cleaner launches and fewer recalls. If management delivers on quality and cost while pacing capital spend, the shares could re‑rate over the medium term; if not, they may remain a high‑yield cyclical tied to macro swings.

This article is not investment advice. Investing in stocks carries risks and you should conduct your own research before making any financial decisions.