NIO Inc. enters late 2025 with improving demand signals but a still‑stressed balance sheet. Trailing‑12‑month revenue stands at 69.42B, yet profitability remains elusive (profit margin -35.01%; operating margin -25.82%), and operating cash flow is negative. Liquidity is tight (current ratio 0.84) with 18.05B in cash against 30.96B in debt, prompting a new $1 billion equity raise that pressured the stock in recent weeks. Even so, shares have rebounded, closing near 7.145, within sight of the 52‑week high of 7.71 and above the 50‑day and 200‑day moving averages. Analysts have turned more constructive, with JPMorgan moving to Overweight and an $8 target, while UBS cites new models and a stronger balance sheet. This three‑year outlook examines how product ramp, funding choices and competition could shape NIO’s risk‑reward from here.

Key Points as of September 2025

- Revenue: 69.42B (ttm); Quarterly revenue growth (yoy): 9.00%; Revenue per share: 32.87.

- Profit/Margins: Profit margin -35.01%; Operating margin -25.82%; Gross profit 7.13B; EBITDA -15.88B; Net income -24.31B; Diluted EPS -1.62.

- Cash flow: Operating cash flow -8.75B (ttm); Levered free cash flow -12.49B.

- Balance sheet/liquidity: Total cash 18.05B; Total debt 30.96B; Current ratio 0.84; Total debt/equity 468.03%; Book value/share -0.54.

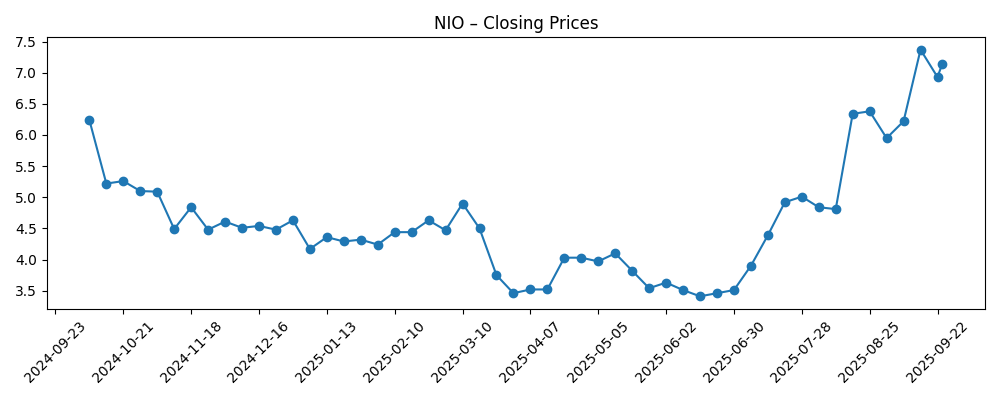

- Share price and trading: Latest weekly close 7.145 (9/24/2025); 52‑week range 3.02–7.71; 50‑day MA 5.51; 200‑day MA 4.45; Beta 1.20; 52‑week change 22.65% vs S&P 500 16.33%.

- Ownership and short interest: Shares outstanding 2.32B; Implied shares outstanding 2.46B; Float 1.6B; Short interest 191.37M (11.66% of float); Short ratio 2.37; Insiders 2.11%; Institutions 7.72%.

- Analyst view: J.P. Morgan reiterated/raised stance with an $8 price target; UBS cited confidence tied to new models and a stronger balance sheet (per headlines).

- Funding and dilution: Headlines highlight a $1 billion share sale; shares fell 8.9% on the announcement, underscoring dilution sensitivity.

- Sales cadence: Headlines point to record deliveries and ES8 deliveries beginning, signaling product refresh momentum.

Share price evolution – last 12 months

Notable headlines

- NIO's ES8 Deliveries Begin This Week: Can It Compete With TSLA and LI?

- NIO Investors Rattled As EV Maker Issues Massive Equity Offering

- Nio to raise another $1 billion via share sale to fund EV program

- Cheche Expands NIO Partnership As Record Deliveries Fuel China EV Insurance Race

- NIO (NIO) Falls 8.9% on $1-Billion Share Sale

- Nio Inc. ADR (NIO) Upgraded to ‘Overweight’ at JPMorgan on Strong Vehicle Demand

- J.P. Morgan Reiterates a Buy on NIO Inc. (NIO), Setting an $8 PT

- Nio’s new models and stronger balance sheet restore confidence, says UBS

- Why Is NIO Stock Plunging Today

Opinion

The equity raise looms over NIO’s three‑year outlook. On one hand, a $1 billion share sale addresses immediate liquidity alongside 18.05B in cash against 30.96B in debt and a 0.84 current ratio. It buys time to execute new models and shore up operations while negative operating cash flow and margins are addressed. On the other hand, dilution is real, evident in the gap between 2.32B shares outstanding and 2.46B implied shares outstanding, and the stock’s drop on the news highlights how sensitive sentiment is to funding moves. The path forward hinges on whether the proceeds translate into capacity utilization, cost reduction, and brand reinforcement. If they do, the offering could mark an inflection point rather than a setback; if not, it risks being a bridge to another raise.

Product execution is the potential offset. Headlines citing record deliveries and ES8 deliveries beginning suggest model freshness and possible mix improvement. Partnerships like the Cheche tie‑up can enhance customer experience and monetization, while analyst support (JPMorgan’s Overweight and an $8 target, UBS’s improved stance) provides sentiment ballast. The share price has recovered toward the top of its 52‑week range, with the latest weekly close at 7.145 versus moving averages of 5.51 and 4.45. That strength, however, carries an expectation: continued delivery momentum and visible cost progress. Any stumble on quality, ramp, or pricing could quickly be reflected in trading given the stock’s beta and active short interest.

The financial base remains the key constraint. Profit margin (-35.01%) and operating margin (-25.82%) underscore that scale alone may not close the gap; mix, pricing discipline, and manufacturing efficiency must also improve. Operating cash flow (-8.75B) and levered free cash flow (-12.49B) indicate that self‑funding is not yet in reach. Debt at 30.96B and a high debt/equity ratio add pressure to show margin traction before maturities or refinancing windows tighten. NIO’s battery‑swap infrastructure and technology investments can be competitive advantages, but they are capital intensive. Over the next three years, evidence of unit economics improvement and stable working capital will likely matter more than top‑line growth alone.

Positioning into 2026–2028, the tug‑of‑war is clear: dilution risk and losses versus new products, partner ecosystem, and a firmer balance sheet. The 52‑week change of 22.65% (versus the S&P 500 at 16.33%) and short interest at 11.66% of float set the stage for elevated volatility around catalysts. Positive delivery updates, margin beats, and incremental funding on favorable terms could extend the recovery toward analyst targets, while pricing cuts, slower ramps, or additional equity could reset expectations. For long‑term investors, the thesis rests on operating discipline turning gross profit into sustainable operating profit; for traders, the focus may remain on momentum against well‑telegraphed news flow.

What could happen in three years? (horizon September 2025+3)

| Case | What it looks like | Implications for NIO |

|---|---|---|

| Best | New models gain traction, cost per vehicle falls, and gross margin expands. Operating discipline lifts the business toward break‑even or better, while partnerships deepen ancillary revenues. | Funding needs ease, future raises occur on stronger terms, and sentiment improves as delivery cadence and margins stabilize. |

| Base | Deliveries grow steadily, but pricing and costs keep margins thin. Execution improves in steps, with periodic product refreshes and selective partnerships. | Occasional dilution persists, balanced by gradual operating progress; the stock tracks delivery updates and cost milestones. |

| Worse | Competitive pricing pressure and cost inflation persist. Ramps slip, and efficiency gains lag, keeping cash burn elevated. | Additional equity raises and/or costly debt increase dilution and risk; valuation compresses until a credible turnaround emerges. |

Projected scenarios are based on current trends and may vary based on market conditions.

Factors most likely to influence the share price

- Execution on new models and delivery cadence (e.g., ES8 ramp, sustaining "record" delivery momentum cited in headlines).

- Margin trajectory via pricing, mix and manufacturing efficiency (profit margin -35.01%; operating margin -25.82%; gross profit 7.13B).

- Funding pathway and dilution risk amid a 0.84 current ratio, 18.05B cash, 30.96B debt, and recent $1 billion share sale.

- Competitive intensity and policy backdrop in core markets, affecting demand and pricing power.

- Sentiment and technicals: short interest 191.37M (11.66% of float), beta 1.20, and reactions to analyst actions and headlines.

Conclusion

NIO’s setup blends improving demand signals with unresolved financial strain. Trailing revenue of 69.42B and headlines pointing to record deliveries and ES8 launches suggest a healthier top line, while analyst support and a share price near the upper end of its 52‑week range indicate renewed confidence. But margins remain deeply negative, operating cash flow is still in the red, and liquidity is tight, explaining the need for a $1 billion equity raise and the market’s sensitivity to dilution. Over the next three years, the story will likely be decided by operating execution: turning gross profit into sustainable operating profit, stabilizing working capital, and funding growth on better terms. If NIO demonstrates consistent delivery cadence and margin improvement, upside remains; if cost progress stalls or further raises arrive without clear returns, volatility and drawdowns could persist.

This article is not investment advice. Investing in stocks carries risks and you should conduct your own research before making any financial decisions.