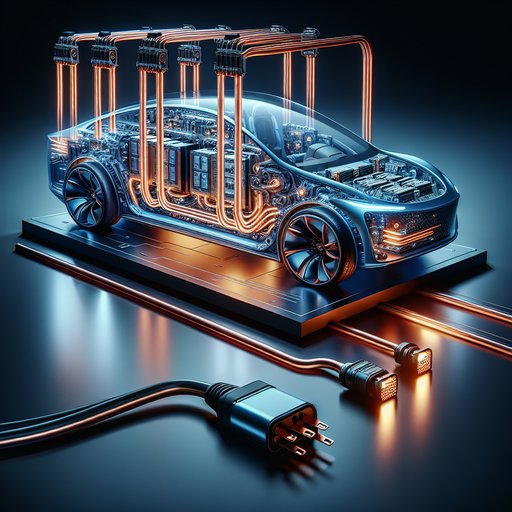

Raising an EV’s DC bus from ~400 V to ~800 V halves current for the same power, slashing I²R losses, shrinking copper mass, and enabling higher fast‑charge rates on 1,000‑V hardware. Automakers from Porsche and Hyundai–Kia to Lucid, GM and Tesla now deploy 800‑V subsystems, paired increasingly with 1,200‑V silicon‑carbide (SiC) switches. The shift isn’t free: insulation, creepage/clearance, EMI, and thermal control grow more demanding, and charging speed remains bounded by cell chemistry and thermal limits. Still, with 350‑kW chargers proliferating and newer vehicles managing 10–80% charges in under 20 minutes, 800‑V is becoming a mainstream tool to improve efficiency, performance, and packaging.

The opportunity is straightforward: at fixed power P, current I scales inversely with voltage V. Doubling V from ~400 to ~800 V cuts I by 2×, so conductor losses (∝ I²R) drop 4× for the same cable. Automakers can trade that margin for smaller cables and busbars, or keep cable size and reduce heat. This improves range (less mass, lower copper loss), packaging (smaller harness bend radii), and cost (copper and cooling overhead).

The constraint is that voltage touches everything. Cell count roughly doubles (e.g., ~96s to ~192s), which affects BMS, fusing, and clearance. Higher dv/dt raises electromagnetic interference and partial‑discharge risk, pushing better shielding, potting, and motor winding insulation. Public fast‑charge hardware must actually support high voltage and current; 800‑V cars still charge at 400‑V stations, but need internal DC–DC boost or pack reconfiguration, which adds cost and complexity.

Cable size reduction is tangible. Delivering 300 kW from pack to inverter: at 400 V, I ≈ 750 A; at 800 V, I ≈ 375 A. To maintain similar current density, cross‑sectional area can fall by ~50% (e.g., ~95 mm² down to ~50 mm²), cutting harness copper mass by ~40–50% and easing routing. Resistive heating drops sharply: a 4 m round‑trip, 50 mm² copper link (~1.4 mΩ) dissipates ~200 W at 375 A, versus ~800 W at 750 A for a similar 100 mm² link.

On the charger side, high‑power CCS cables remain liquid‑cooled to carry 500–600 A continuous; inside the car, most 800‑V traction harnesses can be air‑cooled or lightly heat‑sunk because current is lower. Fast‑charge speed benefits are real but bounded by cell acceptance and thermal limits. Recent data: the 2024 Taycan update peaks near 320 kW on 800‑V HPCs and shortens 10–80% to about 18 minutes; Hyundai–Kia E‑GMP models (Ioniq 5/6, EV6) typically reach 230–250 kW with similar 18‑minute 10–80% windows; Lucid Air exceeds 300 kW under favorable conditions. GM’s 800‑V charging (e.g., Silverado EV) targets up to 350 kW at compatible sites.

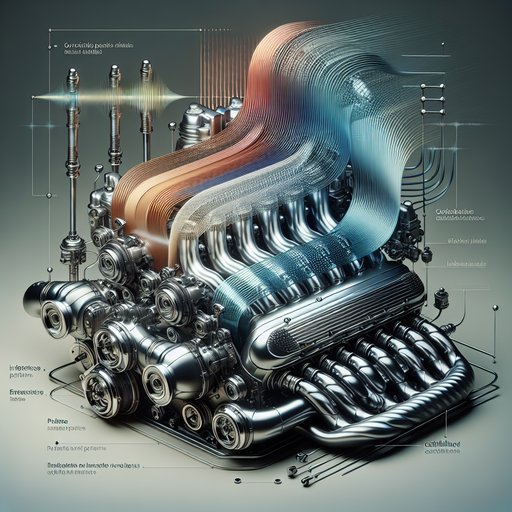

Many networks installed since 2023–2025 advertise 1,000‑V capability and 350‑kW per dispenser; older 400‑V‑limited units cap 800‑V cars unless the vehicle boosts. Porsche and Hyundai include onboard 400→800 V DC boost so 400‑V stations still deliver ~150 kW or more; some platforms reconfigure modules in series/parallel to similar effect. Inverter design is a major enabler. Most 800‑V traction inverters now use 1,200‑V SiC MOSFETs from suppliers like Infineon, onsemi, STMicroelectronics, and Wolfspeed.

Compared with 650–750‑V silicon IGBTs common at 400 V, SiC offers lower switching and conduction losses and can switch faster (tens of kHz) to shrink inductors and capacitors. System efficiency gains of 1–3 percentage points under typical drive cycles are common, and peak inverter efficiencies often exceed 97–99%. Design caveats: DC‑link film capacitors must withstand higher voltage and ripple; gate‑drive and layout must manage fast dv/dt to protect the motor’s insulation and bearings (common‑mode chokes, filters, and improved winding varnishes are typical). Higher pack voltage also increases required creepage/clearance distances per automotive insulation standards, affecting module and connector packaging.

Cooling demands change, but they don’t disappear. Lower current eases harness and inverter copper heating, and SiC’s lower losses reduce heat rejection per kW, allowing smaller cold plates or coolant flow. However, high‑power fast charging shifts the thermal bottleneck to the battery: 250–350 kW equates to ~2–3 C for 80–120 kWh packs, requiring preconditioning (≈25–35 °C), uniform cell cooling (tab/plate designs), and tight SOC/temperature windows to avoid lithium plating. HPC dispenser cables remain liquid‑cooled to sustain 500–600 A, while vehicle‑side charge ports and contactors at 800 V need rigorous thermal and arc management.

Motors see higher dv/dt stress; improved insulation systems and, in some cases, shaft‑grounding help avoid bearing currents. Implications: 800‑V platforms are consolidating where power is high and packaging matters—premium sedans, trucks, and performance EVs—while cost‑optimized 400‑V cars persist. Policy and infrastructure are catching up: many NEVI‑funded U.S. sites and new European installations specify 1,000‑V, 350‑kW dispensers with liquid‑cooled cables, which is key to realizing 800‑V benefits.

As SiC wafer capacity ramps through 2025, device costs should moderate, widening adoption. The net: 800 V is not a silver bullet for charging speed, but, paired with suitable cells and thermal systems, it delivers credible efficiency, mass, and time‑to‑charge gains that translate into better real‑world user experience.