Thermal systems have become the unsung heroes of modern electric vehicles, dictating how fast we can charge, how far we can drive in winter, and how reliably powertrains deliver performance. Across 2023 and 2024, battery makers, Tier 1 suppliers, and automakers quietly rewrote the rulebook with new coolants, pack architectures, and software that orchestrates heat like a resource. The immediate payoff is visible at the plug and on the road: steadier fast‑charging curves, fewer power cutbacks on long climbs, and warmer cabins that sip rather than gulp energy. As 2025 model launches approach, the sector is converging on integrated, multi‑loop designs that share heat between batteries, e‑motors, power electronics, and cabins, squeezing more utility from every watt.

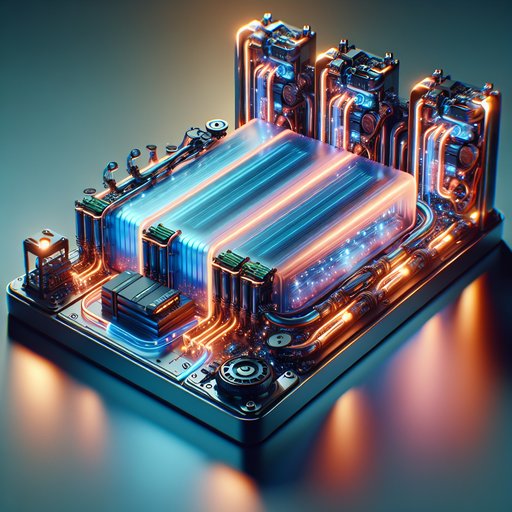

Battery thermal management has advanced from simple base plates to cell‑level solutions. CATL’s Qilin architecture moved liquid cooling channels closer to cells, improving heat transfer and enabling tighter control during fast charging and hard driving; BYD’s Blade form factor, meanwhile, emphasizes thermal stability and propagation resistance. Several suppliers, including M&I Materials with its MIVOLT dielectric fluids, have piloted immersion‑cooled packs that directly bathe cells to even out temperatures and tame hotspots. These approaches reduce degradation, cut the risk of thermal runaway, and keep charging speeds higher for longer in hot or cold weather.

Materials matter too: higher‑conductivity gap fillers from firms like Henkel and better venting from W. L. Gore help pull heat away while preserving pack safety. Drivetrains are benefiting from direct cooling and smarter packaging.

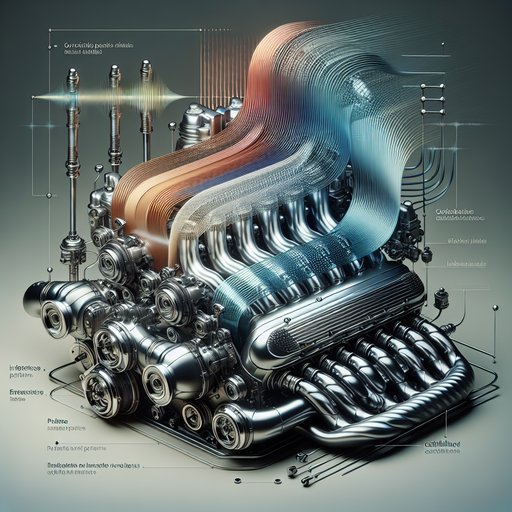

ZF, Bosch, and GM’s Ultium Drive units route oil through stators, rotors, and gearsets, while Mahle’s oil‑cooled SCT e‑motor demonstrated high continuous output by design rather than short bursts. Silicon‑carbide inverters from players such as Wolfspeed, STMicroelectronics, and Infineon waste less energy as heat, shrinking the cooling burden on the whole powertrain. Integrating motor, inverter, and gearbox into compact e‑axles shortens thermal paths and allows shared coolant circuits, which helps prevent power derating on long grades or in high ambient temperatures. The net effect is sustained performance for towing and mountain driving without oversized radiators.

Cabin comfort is shifting from resistive heat to heat pumps and targeted warming. Tesla’s heat‑pump systems, Hyundai–Kia’s E‑GMP heat recovery, and widespread adoption in European EVs brought double‑digit winter range gains by recycling waste heat from the battery and power electronics. Automakers are adding CO2 (R744) heat pumps in colder markets, improving low‑temperature efficiency versus traditional refrigerants. Features like pre‑entry conditioning, intelligent air vents, and radiant surfaces focus energy where occupants feel it most, further shrinking the climate penalty.

By 2024, these strategies translated into quicker defogging, quieter operation, and measurable energy savings on short urban trips. Software has become the conductor of these hardware gains. Multi‑port valves and multi‑loop architectures—popularized by Tesla’s Octovalve and mirrored by GM and others—let vehicles shuttle heat between the battery, e‑motor, power electronics, and cabin as conditions change. Route‑based preconditioning now readies packs for fast chargers en route, preserving peak charge rates and reducing dwell times, while over‑the‑air updates continue to refine thermal thresholds across fleets.

On the safety front, earlier gas detection, improved venting, and pack segmentation slow or isolate thermal events, and better sensors feed data back into predictive controls. Expect the next wave—through 2025 and 2026—to scale immersion cooling in performance segments and broaden CO2 heat pumps, pairing them with cleaner coolants and tighter integration to unlock faster charging and steadier range in all seasons.