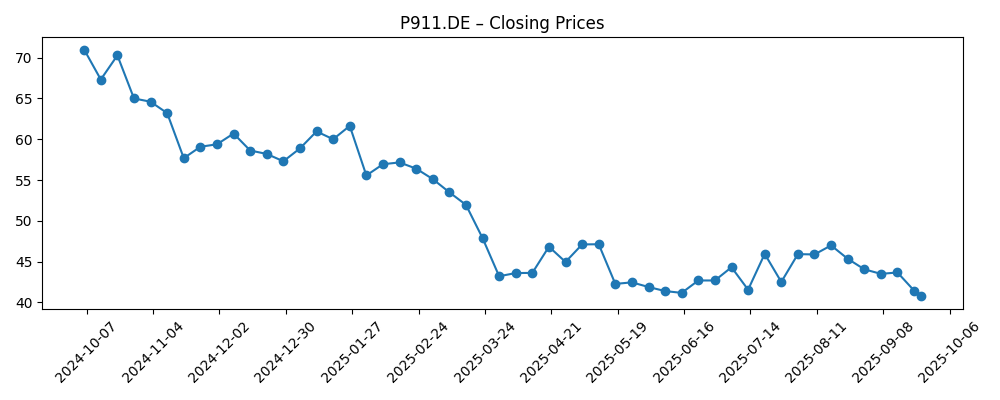

Porsche AG (P911.DE) enters the next three years with solid liquidity and brand strength but with earnings pressure and a slumping share price. Over the last 12 months, the stock is down 35.91% and recently closed near 40.74, well below the 50‑day and 200‑day moving averages of 44.40 and 49.06. On fundamentals, trailing 12‑month revenue is 38.78B with gross profit 9.01B and EBITDA 6.52B, yet quarterly revenue fell 11% year over year and quarterly earnings growth dropped 83.10%. Margins remain positive (operating 7.01%, net 5.58%), operating cash flow is 4.82B, and cash of 6.6B offsets part of 10.85B in debt. A 5.57% forward dividend yield comes with a 97.47% payout ratio. Strategic updates around hybrid 911 models and charging technology could be catalysts into 2026–2028.

Key Points as of September 2025

- Revenue – Trailing 12‑month revenue of 38.78B; quarterly revenue growth is down 11.00% year over year.

- Profit/Margins – Operating margin 7.01% and profit margin 5.58%; returns sit at ROE 9.58% and ROA 4.76%.

- Sales/Backlog – No order/backlog figures provided; product cadence features a hybrid 911 Turbo S and updates to in‑car and charging tech per recent headlines.

- Share price – 52‑week change -35.91% vs S&P 500 +16.33%; last close ~40.74 within a 39.58–75.00 range; below 50‑DMA 44.40 and 200‑DMA 49.06; beta 1.03.

- Analyst view – No consensus shown; trading activity elevated with 10‑day average volume 981.77k vs 3‑month 665.63k.

- Market cap – Not provided; ownership concentrated (insiders 75.80%, institutions 11.20%); reported shares outstanding 455.5M and implied shares outstanding 911M.

- Balance sheet/liquidity – Cash 6.6B vs total debt 10.85B; current ratio 1.44; total debt/equity 46.49%.

- Cash flow/dividend – Operating cash flow 4.82B; levered FCF 352.62M; forward dividend yield 5.57% with a 97.47% payout; last ex‑dividend on 5/22/2025.

Share price evolution – last 12 months

Notable headlines

- Porsche Is Set to Be the First Electric Car Maker to Deliver Wireless Charging Later This Year (CNET)

- The Hybrid Porsche 911 Turbo S Is a New Kind of Fast (HYPEBEAST)

- 2026 Porsche 911 Turbo S (Uncrate)

- Porsche unveils unbelievable new in-car entertainment option — here's everything you need to know (Yahoo Entertainment)

- The Polestar 5 is an 884hp fastback sedan that should make Porsche nervous (The Verge)

Opinion

Porsche’s share price is signaling caution. The stock is off 35.91% over 12 months and sits below both the 50‑day and 200‑day moving averages, indicating a negative technical trend that may require clear operational catalysts to reverse. Fundamentals show resilience but also pressure: trailing revenue is 38.78B with gross profit of 9.01B and EBITDA of 6.52B, yet quarterly revenue declined 11% year over year and quarterly earnings growth fell 83.10%. Those datapoints, combined with a beta near market (1.03), suggest the recent underperformance is more company‑specific than purely macro. The 52‑week range of 39.58–75.00 frames potential downside and upside, but with the last close at 40.74, investor expectations for near‑term improvement look muted pending clearer signs of demand and pricing strength.

The dividend is a focal point. A forward yield of 5.57% offers support, but the payout ratio of 97.47% leaves limited cushion if earnings or cash flows weaken further. Operating cash flow of 4.82B and levered free cash flow of 352.62M indicate an ability to fund the distribution today, though flexibility depends on capital needs for model launches and electrification. The balance sheet shows 6.6B of cash against 10.85B of total debt and a current ratio of 1.44, which appears manageable, but investors will scrutinize cash conversion amid softer revenue. With insiders holding 75.80% and institutions 11.20%, the concentrated ownership structure can magnify moves when sentiment shifts, as suggested by recent volume running above the three‑month average.

Product and technology news could reshape the narrative. Reports of a hybrid 911 Turbo S and potential leadership in wireless charging position Porsche to defend its performance brand while advancing electrification. Enhanced in‑car entertainment may help preserve pricing power in higher‑trim models. Competitive pressure remains real—new entrants such as the Polestar 5 underscore intensifying benchmarks for speed and technology in premium EVs. If Porsche translates its engineering roadmap into compelling deliveries and stable margins, the market may reward credible guidance on product mix, cost discipline, and order momentum. Conversely, delays or tepid reception would keep valuation anchored to current concerns about growth and earnings quality.

Over a three‑year horizon, the base case likely hinges on steady execution, moderated by cautious demand. Maintaining operating margins in a healthy range while stabilizing volumes would support the dividend and gradually rebuild confidence. Upside requires visible commercial success of hybrid/performance models and differentiated tech—wireless charging could be a signature feature if rolled out effectively. The downside centers on continued revenue softness, discounting to move inventory, or an adverse turn in cash flow that forces a dividend reset. Given the 52‑week low at 39.58 and moving averages above spot, investors may seek confirmation through order updates, margin commentary, and capital allocation signals before re‑rating the shares.

What could happen in three years? (horizon September 2025+3)

| Scenario | What it looks like by Sep 2028 | Key drivers to watch |

|---|---|---|

| Best | Electrified 911 and related launches resonate, brand pricing power holds, and cost discipline improves profitability. Dividend maintained with headroom and sentiment turns, lifting the shares back toward the upper end of the recent multi‑year range. | Demand/pricing on new models; evidence of margin expansion; successful rollout of wireless charging and in‑car tech. |

| Base | Execution is steady but demand mixed; margins stabilize; dividend covered but not materially increased. Shares track fundamentals and remain sensitive to newsflow, trading around long‑term moving‑average anchors. | Order updates, mix, and cost control; cadence of tech features; cash conversion vs. investment needs. |

| Worse | Competitive pressure and weak volumes persist; margins compress and free cash flow tightens. Dividend is trimmed or paused to preserve balance‑sheet flexibility; valuation de‑rates toward cycle troughs. | Persistent revenue declines; inventory/pricing actions; execution setbacks on electrification and connectivity. |

Projected scenarios are based on current trends and may vary based on market conditions.

Factors most likely to influence the share price

- Demand and pricing in premium performance and electrified models; sustained revenue pressure has weighed on growth (-11% yoy in the most recent quarter).

- Execution on electrification and technology roadmap (hybrid 911, potential wireless charging, in‑car features) and its impact on margins.

- Margin and cash‑flow trajectory relative to a high payout ratio (97.47%) and levered free cash flow (352.62M).

- Balance‑sheet discipline amid investments (cash 6.6B vs debt 10.85B; current ratio 1.44; debt/equity 46.49%).

- Competitive intensity from premium EV/performance entrants (e.g., Polestar 5) affecting mix and pricing power.

- Ownership concentration (insiders 75.80%, institutions 11.20%) and volume shifts (10‑day avg 981.77k vs 3‑month 665.63k) influencing volatility.

Conclusion

Porsche’s investment case over the next three years rests on reconciling a strong brand and healthy liquidity with cyclical earnings pressure and a demanding dividend. The shares trade near the 52‑week low and below key moving averages, reflecting caution after a 35.91% decline versus a rising S&P 500. Positively, margins remain in the black, operating cash flow is solid, and technology headlines suggest a credible path to defend pricing in core performance segments. However, the combination of lower quarterly revenue and earnings, a high payout ratio, and intensifying competition argues for patience until there is clearer evidence of improving order momentum and margin resilience. For now, income‑oriented holders may value the yield but should monitor cash conversion and capital needs closely. A re‑rating likely requires successful hybrid rollouts, visible tech differentiation, and steadier fundamentals; absent those, the stock may stay range‑bound and dividend sensitivity will remain elevated.

This article is not investment advice. Investing in stocks carries risks and you should conduct your own research before making any financial decisions.