QuantumScape (QS) enters the next three years with rising visibility but persistent execution risk. The stock has rebounded sharply since late June on headlines highlighting a live solid‑state battery demo in a Ducati, punctuating months of volatility. Financially, QS remains pre‑revenue with negative EBITDA and net income, yet it holds substantial cash and minimal debt, giving it room to pursue commercialization. The share price sits well above its 200‑day average and the 52‑week change is positive, underscoring momentum—and a high beta amplifies swings. Short interest remains elevated, reflecting skepticism alongside growing optimism. The key question from here: can demos translate into durable customer programs and, ultimately, revenue without heavy dilution? This outlook assesses QS’s milestones, funding profile, competitive positioning, and catalysts that could shape the stock through September 2028.

Key Points as of September 2025

- Revenue: Pre‑revenue; ttm revenue not disclosed (—).

- Profit/Margins: EBITDA −$397.14M; net income −$463.36M; stated profit margin 0.00%.

- Sales/Backlog: No commercial sales disclosed; recent Ducati demo signals progress; backlog not disclosed.

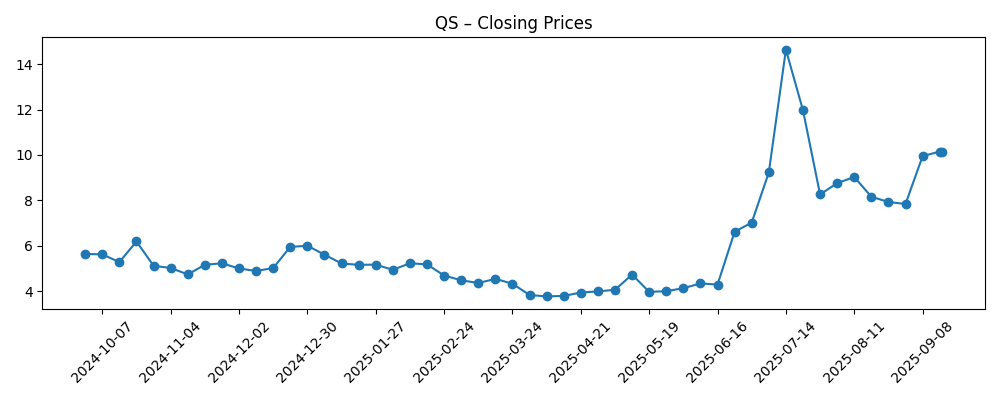

- Share price: ~$10.15 (9/16/2025); 52‑week range $3.40–$15.03; 52‑week change +75.00%; 50‑DMA 9.44; 200‑DMA 5.91; beta 4.43.

- Liquidity: Cash $797.49M (mrq); debt $89.36M; current ratio 16.40.

- Short interest: 54.89M shares short (12.21% of float; short ratio 2.07) as of 8/29/2025.

- Market cap: ≈$5.3B based on ~523M shares outstanding and a $10.15 recent close.

- Ownership: Insiders 19.44%; institutions 34.61%; float 431.44M shares.

Share price evolution – last 12 months

Notable headlines

- QuantumScape Batteries Power Ducati at IAA: Time to Buy QS Stock? (Yahoo)

- QuantumScape (QS) Soars 12% on Electric Ducati V21L Optimism (Yahoo)

- QuantumScape and PowerCo complete first live solid-state battery demo in a Ducati (Electrek)

- QuantumScape Stock Is Up 20% Today. Here's Why. (Investopedia)

- QuantumScape Just Debuted New Solid-State Batteries. Should You Buy QS Stock Here? (Barchart)

- QuantumScape: Is QS Stock The Next Big Multibagger? (Forbes)

- QuantumScape (QS) Jumps 21% as New Ducati Unveils Cobra-Produced Solid-State Battery (Yahoo)

- Ducati’s V21L Is the First Motorcycle Powered by Solid-State Batteries (Hiconsumption)

Opinion

The Ducati demo is a credible proof-of-progress moment for QuantumScape. Public, live operation in a performance motorcycle showcases cycle life, power delivery, and thermal behavior that are hard to convey via lab slides alone. For investors, this validates that QS’s solid-state architecture can deliver under demanding conditions, a necessary step toward automotive qualification. Yet a demo is not a production line. Translating a single or small set of prototype cells into thousands of consistent, automotive-grade units demands tight control over materials, interfaces, and yield. The path from demo to design win, and then to revenue-bearing supply, typically requires extended validation cycles. That is why the stock’s sharp rally is rational as a repricing of probability—but not a guarantee of commercialization on a fixed timetable.

Funding remains a pivotal variable. With $797.49M in cash against negative operating cash flow and EBITDA, QS appears positioned to finance further pilot lines and customer programs without immediate balance-sheet stress. Low absolute debt and a high current ratio indicate flexibility. However, scaling solid-state cells is capital-intensive and timelines can slip, increasing the odds of additional equity issuance—especially if management seeks to accelerate manufacturing capacity ahead of signed long-term agreements. The share count dynamics (implied shares exceeding basic shares outstanding) are a reminder that dilution risk is not theoretical. In this context, milestone cadence—pilot line progress, third-party validation, and initial off‑take indications—will determine whether the market funds growth at favorable terms.

The competitive backdrop is tightening. Comparative coverage that pits QuantumScape against SES AI underscores how investors benchmark progress on energy density, cycle life, fast charging, and manufacturability. The Ducati showcase elevates QS in the narrative, but peers are also iterating quickly with their own partnerships and pilots. In next‑gen batteries, the winner may not be singular; end markets are large and diversified across two-wheelers, premium autos, commercial vehicles, and stationary storage. QS’s advantage will hinge on reproducibility at scale and integration ease for OEMs. Clear, frequent, and independently verified disclosures on performance under automotive test protocols will be crucial to sustain the current valuation premium embedded in the post‑summer rally.

QS’s share price behavior reflects sentiment whiplash: a spring trough near the 52‑week low, a midsummer surge toward the 52‑week high, and a consolidation around the 50‑day average. Elevated beta and short interest amplify swings around headlines. That can cut both ways: positive technical milestones may trigger short covering and momentum inflows, while setbacks could cascade through risk management triggers. For a three‑year horizon, the key is to focus on milestones that shift the probability of commercialization—durability at scale, manufacturability, and initial customer programs—rather than day‑to‑day volatility. If QS sequences these steps, the rally can broaden from speculative to fundamental; if not, the stock could re‑rate toward balance-sheet value until new evidence emerges.

What could happen in three years? (horizon September 2025+3)

| Scenario | Summary |

|---|---|

| Best | QS advances from demos to limited commercial supply in select niches (e.g., performance vehicles or pilot fleets), supported by one or more customer programs. Manufacturing yields stabilize, independent validation confirms durability and fast‑charge metrics, and the company maintains a prudent funding mix that limits dilution. Investor focus shifts from technology risk to scaling and margin pathways. |

| Base | Extended pilot phase continues with iterative improvements and additional demos. QS secures memoranda of understanding or conditional agreements but remains early in revenue. Cash resources are actively managed; modest external funding is raised to bridge to commercialization. Share price tracks milestone delivery and broader EV sentiment, with volatility driven by short interest and news flow. |

| Worse | Technical hurdles (e.g., interface stability or manufacturing yield) delay programs, prompting larger‑than‑expected capital needs. Competitive alternatives gain traction with OEMs, pushing QS to revisit its roadmap or target applications. The stock de‑rates toward balance‑sheet support until clear technical inflections are demonstrated. |

Projected scenarios are based on current trends and may vary based on market conditions.

Factors most likely to influence the share price

- Manufacturing yield and consistency of solid‑state cells during pilot and scale‑up phases.

- Customer milestones: formal program wins, off‑take indications, or third‑party validations following demos.

- Capital strategy: timing and size of any equity raises versus cash burn, given $797.49M cash and low debt.

- Competitive developments, including progress by SES AI and other next‑gen battery efforts.

- Macro EV demand cycles and policy incentives that affect OEM adoption timelines.

- Short interest dynamics and technical factors around the 50‑ and 200‑day moving averages.

Conclusion

QuantumScape’s recent Ducati demonstration has moved the story from purely laboratory claims to performance under real‑world conditions, which helps explain the stock’s strong turn from its spring lows. Financially, the company remains pre‑revenue with sizable losses, but it carries substantial cash, minimal debt, and a high current ratio—ingredients for continued development without immediate balance‑sheet strain. Over the next three years, the investment case turns on whether QS can convert demos into durable customer programs and then repeatable production at acceptable yields. Competition is active, and funding needs may persist, but the addressable market is broad and supportive of multiple technologies. For investors, tracking validation milestones, manufacturing updates, and any early commercial commitments will matter more than day‑to‑day volatility. If QS executes, the recent rally could mark the start of a longer transition from promise to product; if progress stalls, the shares may reset until clearer evidence emerges.

This article is not investment advice. Investing in stocks carries risks and you should conduct your own research before making any financial decisions.